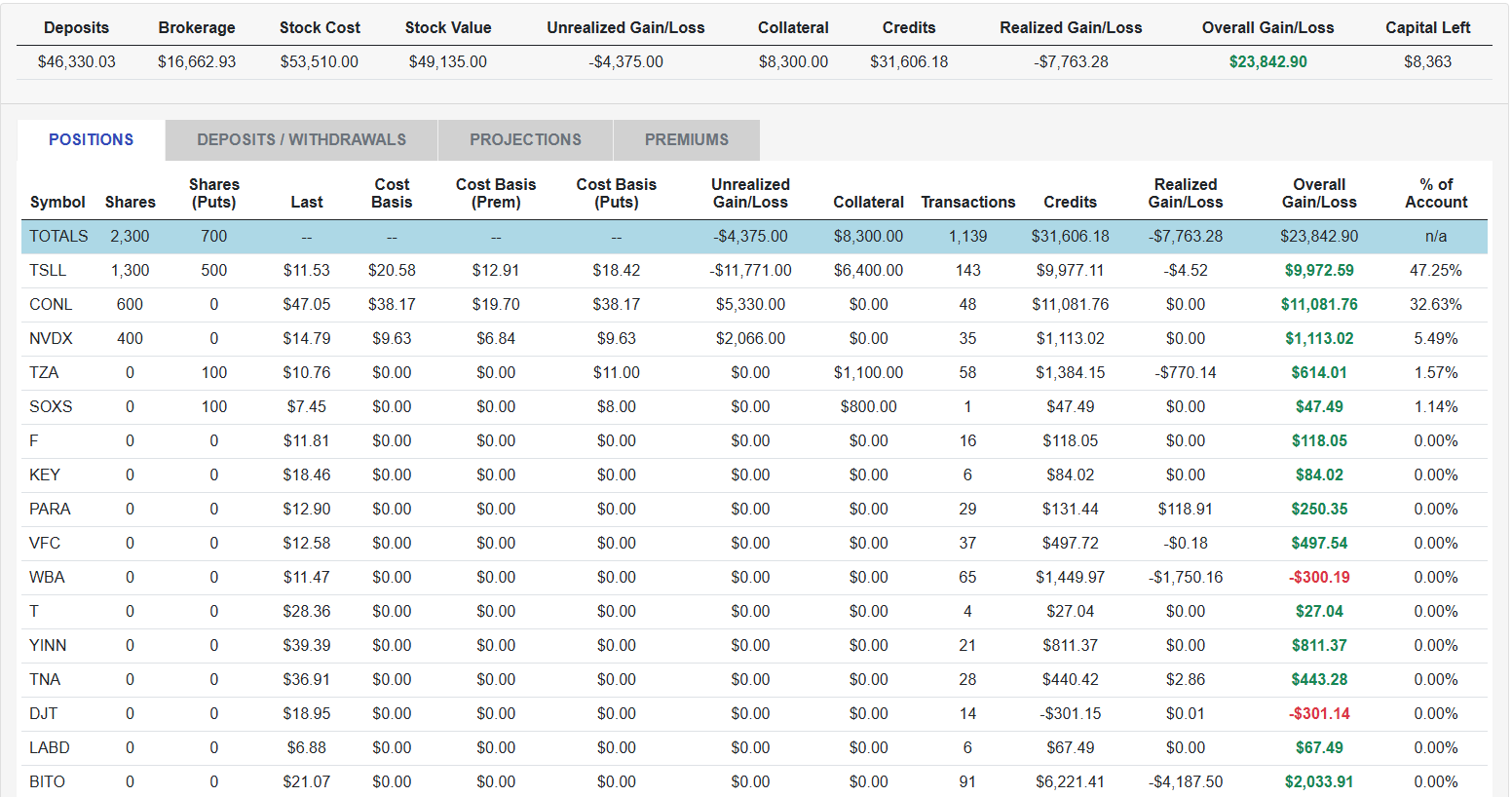

Portfolio-Wide Performance Metrics

Get a complete view of your entire options portfolio at a glance. MyATMM provides comprehensive performance tracking across all your positions, giving you the insights you need to make informed trading decisions.

- Multiple Portfolios: Members can create up to 10 separate portfolios to organize positions by strategy, account, or any way you like

- Daily Performance: Track your portfolio's performance day-by-day

- Monthly Summaries: Review monthly gains, losses, and premium collected

- Annual Reports: Year-over-year performance metrics and trends

- Per-Ticker Analysis: Drill down into individual stock performance

- Visual Dashboards: Clean, organized views of your portfolio data

Whether you're managing a few positions or dozens of tickers across multiple portfolios, you'll always know exactly where you stand.

Simple, Focused Interface

MyATMM was built by an option seller, for option sellers. Every feature is designed specifically for tracking covered calls and cash-secured puts—no unnecessary complexity, no bloated features you'll never use.

- Clean Dashboard: See all your positions without clutter or confusion

- Intuitive Navigation: Find what you need in seconds

- Mobile Responsive: Manage your portfolio from any device

- Fast Loading: No waiting around—get your data instantly

- Purpose-Built Tools: Every feature tailored to the wheel strategy and option selling

Stop fighting with complicated software. MyATMM gives you exactly what you need, when you need it.

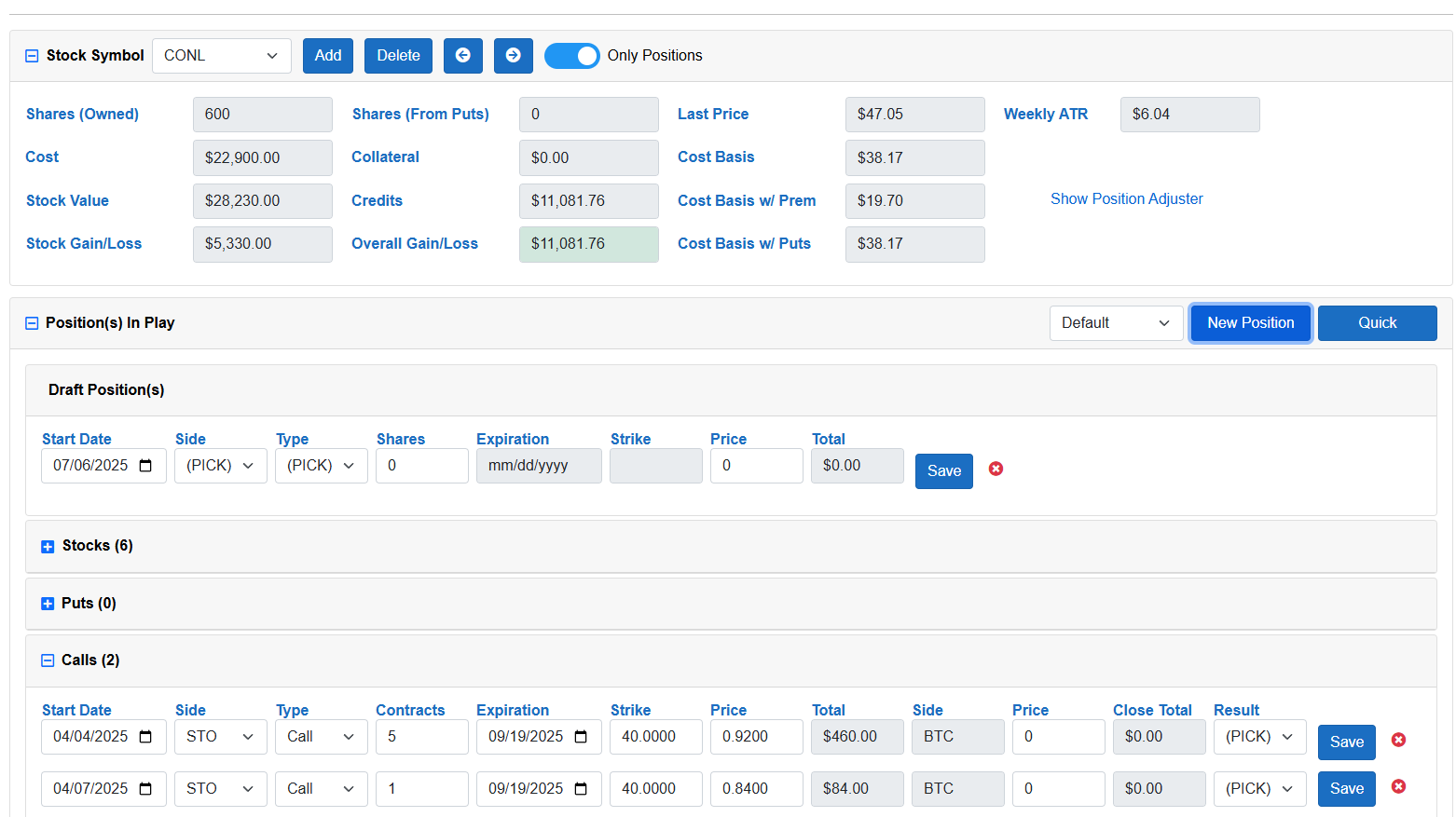

Option Premium Tracking

Every dollar of premium you collect matters. MyATMM automatically tracks and factors all option premiums into your ongoing cost basis calculations, giving you an accurate picture of your profitability.

- Covered Call Premiums: Track every premium from calls you sell

- Cash-Secured Put Premiums: Monitor put premiums collected while waiting for assignment

- Rolling Adjustments: Record premiums from rolling positions

- Assignment Tracking: Automatically adjust cost basis when assigned

- Premium History: Review all premiums collected over time

Know your true return on every trade, including all the premium you've collected along the way.

Dividend Integration

If you're selling options on dividend-paying stocks, MyATMM tracks those dividend payments alongside your option premiums for a complete view of your income-generating strategy.

- Dividend Tracking: Record dividend payments as they're received

- Ex-Dividend Date Awareness: Know when you're eligible for dividends

- Integrated Income View: See option premiums + dividends in one place

- Total Return Calculation: Understand your complete income picture

- Historical Dividend Data: Review past dividend payments

Maximize your income strategy by tracking both option premiums and dividend payments together.

True Cost Basis Tracking

Your brokerage doesn't track cost basis the way option sellers need it. MyATMM factors in every transaction type to give you the most accurate cost basis possible.

- Stock Purchases: Track initial stock buys and assignments

- Stock Sales: Record sales from called-away positions

- Option Premiums: Reduce cost basis by premiums collected

- Dividends: Factor dividend income into your calculations

- Multiple Views: See cost basis with and without premiums

- Proposed Cost Basis: View potential cost basis with active cash-secured puts

Get the real numbers on every position so you can make better trading decisions.

Data Export

Your data is yours. Download your complete transaction history anytime you want—complete peace of mind.

- Transaction History Export: Download your entire transaction history

- CSV Format: Export to CSV for easy import into spreadsheets or other tools

- Data Portability: Take your data wherever you need it

- Backup Confidence: Keep your own backup of your trading records

- Cloud Security: Your data is already safe in AWS with regular backups

We're committed to data transparency and giving you full control over your information.

AI Import Assist Coming Soon

Daily transaction entry shouldn't feel like a chore. Our upcoming AI Import Assist feature will streamline your daily workflow by helping you capture and enter transactions quickly.

- Screenshot Capture: Paste screenshots from your thinkorswim account statement

- Smart Recognition: AI identifies transaction types, dates, strikes, and amounts

- Review & Map: Review each parsed transaction and map to existing positions

- Position Management: Assistance with new positions, rolls, and assignments

- Manageable Batches: Process transactions in small batches for careful review

Designed for daily use—capture your day's trades quickly and accurately with AI assistance.

Bulk Import Coming Soon

Have years of trading history? Our upcoming Bulk Import feature will help you bring all your historical transactions into MyATMM quickly and accurately.

- CSV Import: Upload transaction history exports from your brokerage

- Custom Field Mapping: Map columns from your CSV to MyATMM transaction fields

- Broker Format Support: Pre-built mappings for popular brokers like TD Ameritrade, Schwab, Fidelity, and more

- Validation & Preview: Review parsed transactions before importing

- Batch Processing: Import hundreds of transactions at once

Perfect for getting started with MyATMM—import your existing trading history and hit the ground running.

Multiple Portfolios Members Only

Organize your trading across multiple portfolios. Whether you're tracking different accounts, strategies, or asset classes, MyATMM makes it easy to keep everything organized.

- Up to 10 Portfolios: Members can create up to 10 separate portfolios

- Track Multiple Accounts: Keep your IRA, taxable, and 401(k) positions separate

- Independent Metrics: Each portfolio has its own performance dashboard

- Easy Switching: Quickly jump between portfolios from the dashboard

Free accounts include 1 portfolio. Upgrade to a membership for up to 10 portfolios.